I say all of that to say this, make no mistake about it. The GOVERNMENT IS DOING JUST FINE because “We The People” are footing a massive portion of the bill.

Warning: This isn’t necessarily a fun read; however, it’s an educational ride that I hope will transform our thinking in a better way.

Fact: the financial impact of the novel coronavirus on the United States has been undeniable. It is fair to say that COVID-19 has not only stirred a public health crisis, but it has prompted an economic crisis as well. The Brookings Institute released its research on the impact of COVID-19 on the American financial system. In an era of “fake news,” it's important to note that the “Brookings Institution is a nonprofit public policy organization based in Washington, DC. [Their] mission is to conduct in-depth research that leads to new ideas for solving problems facing society at the local, national and global level.” I know, I know, but you have to do that now. Anyway…

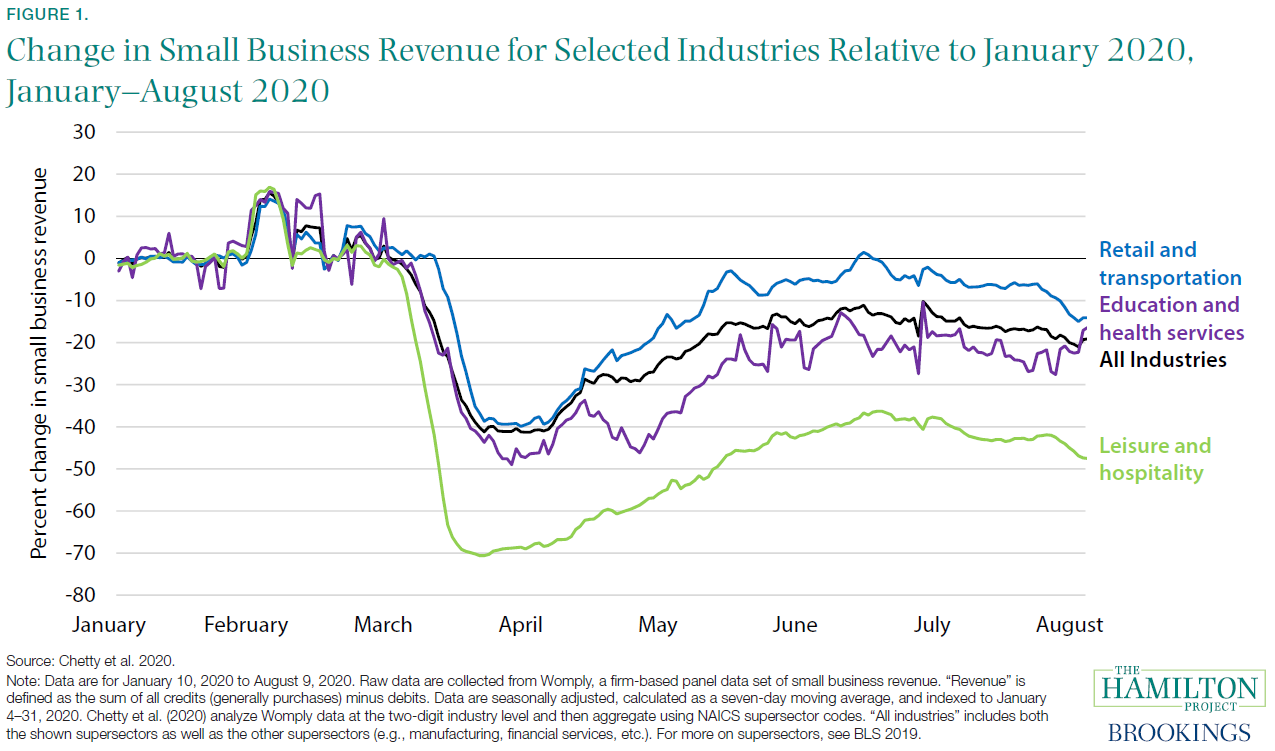

So, on September 17, 2020, the Brookings Institution released its research concerning “Ten Facts About COVID-19 and the U.S. Economy.” The article is in-depth. It focuses on the economic impact of COVID-19 in areas ranging from the living environment, race, ethnicity, disease, and wage earnings. While the entire article is deserving of a read, I’d like to provide you with 4 of the 10 facts obtained during their research.

I could go on; however, I think you get the point.

In the same month, only 11 days later, Business Insider released an article detailing “the average amount Americans pay in federal income taxes, by income level.”

(Trust me, I'm going somewhere with all of this.) The article began to dissect Americans' income taxes by adjusted gross income and inclusion of the number of income taxes filed in total. Business Insider reported that “among the 153 million Americans who filed tax returns in 2018, the average federal income tax payment was $15,322.” It is important to note 2 things: 1.This is an average. This means that some paid more and some paid less; however, all were averaged $15K was the total. 2.This is not the REFUND average; this is the payment. This represents an average of 153,000,000 Americans. So, we could note that the U.S. Government collected $15K x 153 Million people for kicks. That number should probably look like this: $22,950,000,000!!! WHAT?! No, don’t get carried away. It’s not as if the Government has this money in an account just sitting. Much of this is committed even before it's collected. It goes to national defense, social security, politician salaries (which is a whole other conversation), and roadways, to name a few. And while this number is impressive, I haven't even begun to talk about the “other” taxes: property tax, sales tax, citations, fines, vehicle registrations, payroll tax, FICA, dividend taxes, or even road tolls. I say all of that to say this, make no mistake about it. The GOVERNMENT IS DOING JUST FINE because “We The People” are footing a massive portion of the bill. (Stay with me, we're almost there.) Americans for Tax Fairness released a “Fact Sheet“ on how the American economic system taxes the wealthy. They noted the following:

(Almost there…) The Washington Post created and updated a database that details the Small Business Administration’s (SBA) issuance of Paycheck Protection Program (PPP) “loans.” Upon review, “the data includes the exact amounts for more than 600,000 small businesses and nonprofit organizations that received at least $150,000 in loans, of the $2 trillion Cares Act.” You should note that many of these funds went to major corporations, those ran by the CEOs we mentioned earlier. Also, a great deal of these loans was reported in the millions. It is also important to note that “the Justice Department had charged more than 50 people with fraudulently obtaining PPP loans that resulted in at least $80 million in losses. $80 MILLION!! Again, I say all of that to say (or ask) this… How in the world are we as a people allowing the Government to “gaslight” us in our hour of necessity and showering the most affluent in their time of “need?” We have elected officials acting as if providing the American people with $2,000 is a financial liability. Meanwhile, households with no record of income tax payment, and corporations with massive wage gaps, have no problem gaining “bailouts” when they stand in need. What’s up with that?! At some point, we’re going to have to look at our elected officials, their political positions and ask, where do they stand? Are they busy ramping up their base or advocating for their constituency? Here’s the sad part… Advocating for the needs of everyday Americans and demanding that the Government (financed by the people), in times of need, ought to support the people (not just the profits); both of these notions have been deemed far too progressive and liberal. Thus, progressive politics have been considered “bad” for America. To suggest that OUR tax dollars be not just for corporations but also for the commonwealth has been considered liberal and copious. However, the problem is that this speech only comes when it’s time for everyday Americans to gain aid that the corporations enjoy regularly. I refuse to be led by those who deny our struggles and, at the same time, pamper the pampered. I'm focusing my ballot on those who understand that “we” matter as well. Because, contrary to popular belief, “progressive” politics are simply commonsense politics. Your thoughts? Kevin D. Jones, Sr.Author and Publisher of Perfectly Imperfect Perfectionist

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Kevin D. Jones, Sr.Believer - Leader - Flawed Topics:

All

|

RSS Feed

RSS Feed